Tax deductible donations

By making a donation to Oxfam Australia today, you can help tackle the inequalities that fuel poverty — and potentially claim a deduction on your tax return.

What is a tax deductible donation?

A tax deductible donation is an easy way to help support causes you value. Donations of $2 or more made to an Australian Deductible Gift Recipient (DGR) like Oxfam Australia are tax deductible in Australia. This means they may reduce the amount of income tax you need to pay in Australia.

This page sets out some of our tax deductible donation FAQs.

Disclaimer: the information on this page is general in nature and you should always speak to your tax advisor about your individual circumstances.

How to make a tax deductible donation

Making a tax deductible donation is easy. Here’s how it works:

Choose a charity that’s an Australian Deductible Gift Recipient (DGR) to receive your gift

![Give a tax-deductible donation, either online, via phone or by mail [image – present with a bow] Give a tax-deductible donation, either online, via phone or by mail [image – present with a bow]](https://www.oxfam.org.au/wp-content/uploads/2024/02/tax-thumb-2.png)

Give a tax deductible donation, either online, via phone or by mail

![Hold onto your receipt— you’ll need it at tax time [image – receipt] Hold onto your receipt— you’ll need it at tax time [image – receipt]](https://www.oxfam.org.au/wp-content/uploads/2024/02/tax-thumb-3.png)

Hold onto your receipt — you’ll need it at tax time

![Remember to claim your donation at tax time [image – pile of coins] Remember to claim your donation at tax time [image – pile of coins]](https://www.oxfam.org.au/wp-content/uploads/2024/02/tax-thumb-4.png)

Remember to claim your donation at tax time

Tax Deductions Calculator

Use our tax deductions calculator to get an idea of the potential tax savings from a donation of $2 or more to an Australian Deductible Gift Recipient (DGR) such as Oxfam Australia. Enter in the amount you wish to donate and your tax bracket to see the potential tax savings.

Disclaimer: The tax deductions calculator is illustrative and general in nature. It should not be relied upon and is not legal or tax advice. The calculator is based on current income tax rates in Australia and does not take into account the Medicare Levy or other factors which may be relevant to you. Because everyone’s circumstances are different, you should always speak to your legal or tax advisor about your individual circumstances.

Why give to Oxfam Australia?

At Oxfam Australia, we believe all lives are equal and no-one should live in poverty.

We believe that in a wealthy world, poverty is unjustifiable and preventable, and that the present state of inequality and injustice must be challenged. We believe that, with the right help, people can change their lives for the better.

That’s why we are part of a global movement of people working together to eliminate poverty by tackling inequality.

We work at the community level to create change now and in the future. We also advocate to address the systems that keep people in poverty. Working with partners, allies, communities and our supporters, we are changing the world for the better.

Where does the money go?

Thanks to you, Oxfam reached 15.5 million people across 90 countries around the world during 2022-2023.

Of this figure, Oxfam Australia supported more than 2.7 million people in 32 countries, including more than 1.35 million women.

Oxfam worked with 280 partners and directly impacted the lives of more than 285,000 people. We are reaching more than 2.5 million people with life-saving aid during an emergency.

Oxfam Australia also influenced more than 15,000 people and 3,400 organisations to advocate for a fairer world.

By making a charitable donation, you are helping to build more climate-resilient communities, amplify the voices of First Nations people, create opportunities for women to succeed, grow sustainable livelihoods and deliver humanitarian aid.

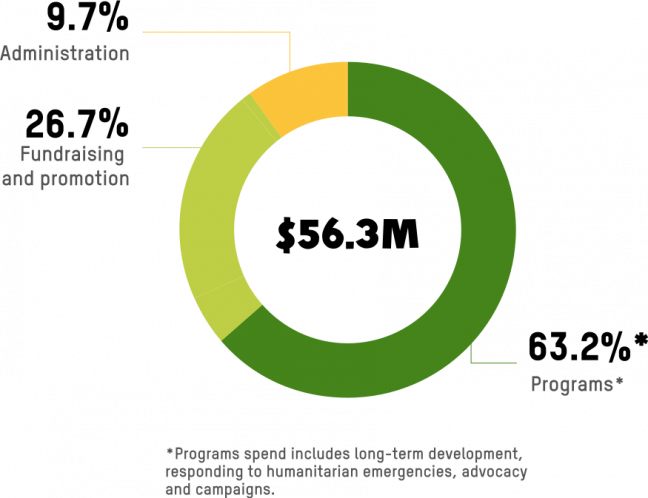

For every $1 we spend*:

- 63 cents is used to directly support our development and humanitarian programs around the world

- 27 cents is invested to generate future income

- 10 cents is spent on essential administration

*Based on Oxfam Australia’s consolidated financial statements for the financial year ended 31 March 2023.

What are the potential tax benefits of donating to a charity with DGR status?

By donating to a charity with Australian Deductible Gift Recipient (DGR) status like Oxfam Australia, you may be able to claim a deduction in your tax return. This could mean a reduced tax bill or a better tax refund at the end of the financial year.

Donations of $2 or more made to Oxfam Australia are tax deductible in Australia. By making a tax deductible donation, you can support a cause you care about and claim a tax deduction for your donation.

To claim a deduction, you need to hold onto your receipts for your donations. Let your accountant know about donations you have made when completing your tax return. If you’re doing your own tax return, there will be a prompt asking you to provide details of your tax deductible donations.

Frequently asked questions

Does claiming a tax deduction affect the amount that Oxfam Australia receives?

No. Even when you claim a tax deduction, Oxfam Australia receives the full amount of your donation.

When is a donation or gift tax deductible?

There are certain conditions that must be met for a donation or gift to be tax deductible. These are set out on the website of the Australian Taxation Office (ATO).

For example, the donation or gift must be made to an Australian Deductible Gift Recipient (DGR). Not all charities are DGRs. Oxfam Australia is a DGR.

The donation or gift must truly be a donation or gift (a voluntary transfer where you receive no material benefit or advantage), be money or property (this can include financial assets such as shares), and comply with any other conditions that are applicable (for example, when giving gifts of property).

The donation or gift must be for $2 or more and you must retain a record (for example, a receipt). See here for more information.

Will Oxfam Australia provide me with a receipt for my donation or gift?

Yes. Our supporter service team at Oxfam Australia are also always happy to send tax receipts via email or mail when you make a tax deductible gift. You should retain a copy of your receipt.

What are the potential tax savings?

You can use our tax deductions calculator to get an idea of the potential tax savings from a donation of $2 or more to an Australian Deductible Gift Recipient (DGR) such as Oxfam Australia.

Disclaimer: The tax deductions calculator is illustrative and general in nature. It should not be relied upon and is not legal or tax advice. The calculator is based on current income tax rates in Australia and does not take into account the Medicare Levy or other factors which may be relevant to you. Because everyone’s circumstances are different, you should always speak to your legal or tax advisor about your individual circumstances.

Can businesses donate to Oxfam Australia?

Yes, Oxfam Australia gratefully accepts donations from most businesses. You can find Oxfam Australia’s Gift Acceptance Policy here.

Many businesses consider philanthropy an important part of their model, would like guidance on the best place to donate. Read about our community of philanthropists within the Oxfam Circle to understand why a donation to Oxfam Australia can have such a wide-ranging and lasting impact on communities that are in desperate need of support.

How do I donate to Oxfam Australia?

Oxfam Australia is a not-for-profit registered charity in Australia aiming to eliminate poverty by tackling inequality. We are committed to achieving climate justice, First Peoples justice, gender equality, ending economic inequality and aiding people during humanitarian emergencies. Any donations made to Oxfam Australia are received gratefully and put towards our many important causes. If our goals and values at Oxfam Australia align with yours, please consider a donation.

Tax deductible donations help make the decision to donate to worthwhile causes even easier. You can make a difference to communities we work with around the world when you make a tax deductible donation.

When you make a donation to Oxfam Australia, you know your money is going to a worthwhile cause that is engaged in the worldwide battle against poverty and inequality.

We strongly encourage you to get involved. Donating to Oxfam Australia has never been easier.

Head to our Donate page, or download our If. Then. Give! App and make a donation today.

Want to learn more?

Read the latest news and stories from Oxfam’s charity work around the globe.

Australia among least generous for aid: Oxfam

In a time of unprecedented global crises and rising inequality, Australia’s international aid contributions remain at historic lows, according to figures released today by the Organization for Economic Cooperation and Development (OECD). The figures show that Australia’s ranking remains low, at 26 out of 31 for official development assistance (ODA) provided by Development Assistance Committee […]

More than 250 humanitarian and human rights organisations call to stop arms transfers to Israel, Palestinian armed groups

An open call to all UN Member States to stop fuelling the crisis in Gaza and avert further humanitarian catastrophe and loss of civilian life. We, the undersigned organisations, call on all States to immediately halt the transfer of weapons, parts, and ammunition to Israel and Palestinian armed groups while there is risk they are […]

People in northern Gaza forced to survive on 245 calories a day, less than a can of beans – Oxfam

Miniscule amount is less than 12% of average daily calorie needs People in northern Gaza have been forced to survive on an average of 245 calories (1025 kilojoules) a day – less than a can of beans – since January, as Israeli forces continue their military onslaught. Over 300,000 people are believed to still be […]