By Degan Ali, Executive Director Adeso, and Ed Pomfret, Somalia Campaigns and Policy manager Oxfam.

At a time where ‘resilience’ seems to be the new buzzword on the tip of everyone’s tongue, one of Somalia’s most resilient systems – remittances – is hanging by a thread.

The money sent home to loved ones by Somalis living abroad makes up a huge proportion of the country’s economy – estimates put the figure at somewhere between 25% and 40%. Every year, Somalia receives approximately AU$1.6bn in remittances, exceeding the amount it receives in humanitarian aid, development aid and foreign direct investment combined. From Australia alone, an estimated AU$33.5m in remittances are reportedly sent to Somalia annually – more than double the AU$15m in Australian humanitarian assistance to Somalia in 2014.

Nearly half of the Somali population depends on remittances to meet their everyday needs.

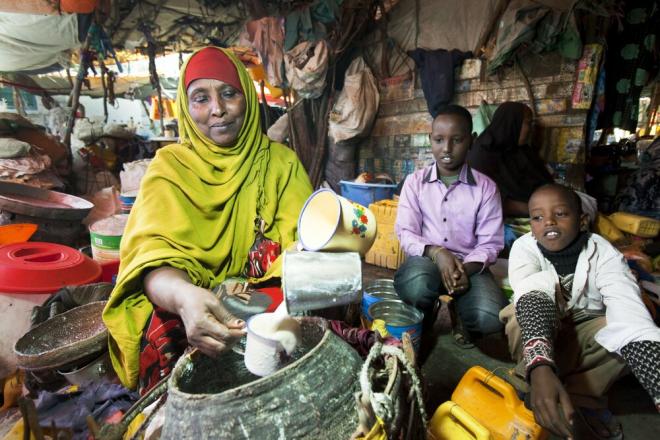

When people receive money, they spend it on essentials such as food, water, education, clothing, housing or medicine. In a country where close to three quarters of a million people are reliant on humanitarian aid for survival and where funding to deal with the crisis is always too little, these funds provide a lifeline on which millions of people depend.

Suhair Farah Ismail, a mother of five in Somalia, sums up why this is such an important issue: “This money is used to cover all our basic needs such as food, water, and school fees for my children. We are fully dependent on the money. Without it we would not survive.”

“This money is used to cover all our basic needs such as food, water, and school fees for my children. We are fully dependent on the money. Without it we would not survive.”

Today, this flow of money is under threat like never before.

A new report released by Adeso, Global Center for Cooperative Security and Oxfam “Hanging by a Thread: The ongoing threat to Somalia’s remittance lifeline” outlines what has happened over the past year in the battle to save this lifeline.

Strong counter terror and anti money-laundering regulations have pushed many banks to shut down the accounts of Somali money transfer operators (MTOs) because of the lack of credible identification schemes and ongoing conflict in Somalia.

Two weeks ago, Merchants Bank of California, which handles between 60-80% of the money transferred from the USA to Somalia, shut down these accounts, leading many MTOs to shut their doors. With the few small banks left this system could soon collapse. While long-term solutions are being worked out, the US Treasury needs to act urgently to put in place a stopgap measure to ensure the money keeps flowing, such as safe harbours for banks doing business with licensed and regulated Somali MTOs.

Even here in Australia, a similar situation is brewing following the announcement by Westpac Bank, the one major bank that is still banking remittance companies thatit will close their bank accounts by end of March this year. The Australian government is following developments closely and has made some progress through the establishment of a working group to look at long term solutions, but needs to ensure that contingency measures are put in place to address any disruption in the flow of remittances.

Strong counter terror and anti money-laundering regulations have pushed many banks to shut down the accounts of Somali money transfer operators

In the UK, where Barclays Bank closed the accounts of remittance companies last year, the UK Government has actually taken some forward looking steps by setting up a pilot project to try and secure the flow of money from the UK to Somalia. Although a good response to the crisis, implementation has been slower than expected and the situation in America and Australia highlights the urgency of action.

While governments overseas take steps to address the problem, the underlying structural problems causing this crisis also need to be tackled. Somali territories urgently need to improve financial management and transparency, including strengthening Somali formal banking systems with the support of countries with major Somali populations

As Hawa Abdullahi Warsame who lives in Badhan, Somalia, explains: “People’s entire lives are dependent on these remittances, and until the day that Somalia can take care of its own people, we remain dependent on them.

“This is not just extra money: this is money that I need to survive on a daily basis. Not only am I dependent on it, but over ten relatives – my entire extended family – are as well. I have sick relatives who need medication, and children that I am trying to provide an education for. This money is vital for that. If I did not receive this money we would not be able to survive and I am scared to even think about what could happen.”

Somalia is at a crossroads, and if we truly want to support the country as it strives to rebuild itself, we should be doing everything in our power to support the most resilient system that exists in Somalia today, instead of trying to destroy it.