Over the course of a year, Oxfam has spent hundreds of hours researching and documenting links between Australia’s big banks and multinational agriculture and timber businesses that are land grabbing in some of the world’s poorest communities.

Oxfam released the ‘Banking on Shaky Ground’ report in April 2014. This included four case studies relating to each of Australia’s big four banks. Almost eight weeks prior to the release of this report, each of the big banks were given the opportunity to respond to the information Oxfam had gathered and to provide comment or dispute the facts that Oxfam had pieced together.

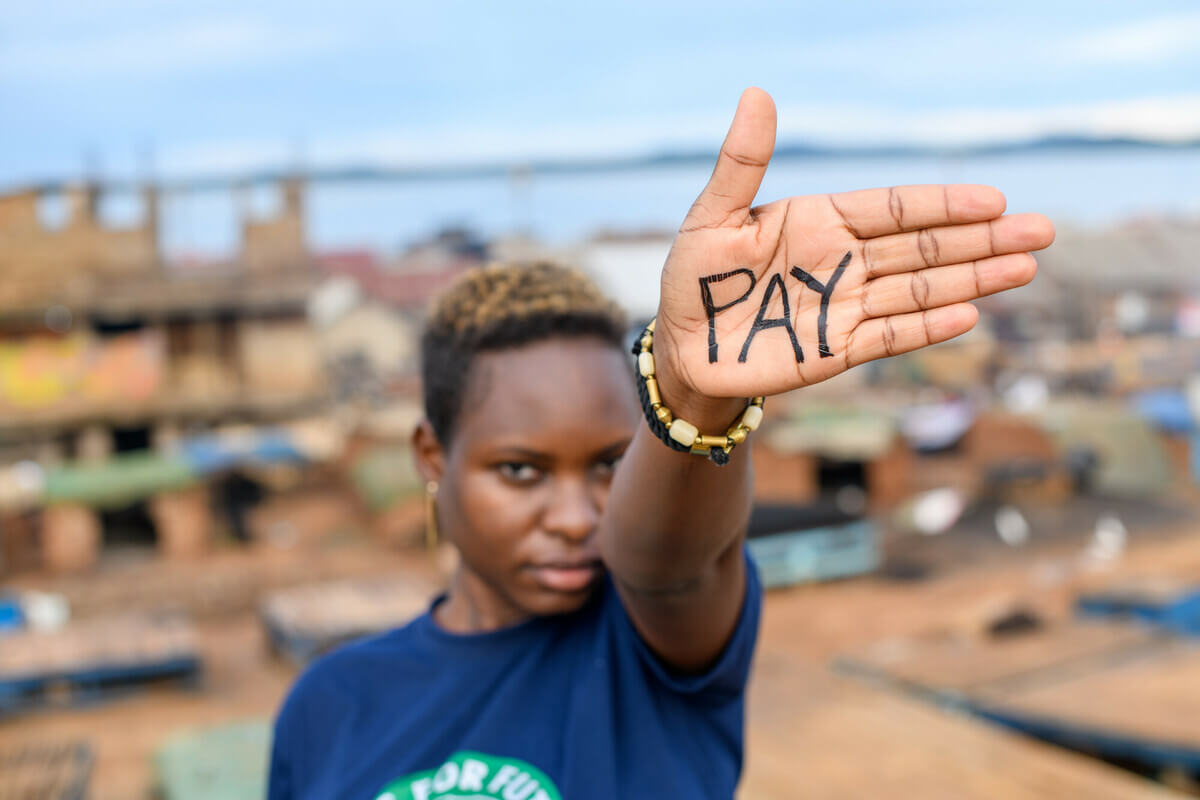

Since the release of the report, Oxfam, together with partner organisations and affected local communities, have been running a public campaign to get Australia’s big four banks to introduce a range of measures that will ensure that they don’t support land grabbing in developing countries (the totality of these measures is known as a “Zero Tolerance for Land Grabs approach”.)

This “Banks and Land campaign” has had tremendous success.

Two big announcements, one each from the NAB and Westpac, are particularly notable. Both are complicated, but in short amount to the first steps towards ending land grabbing. Westpac’s announcement was particularly significant as it states that it will not finance agribusinesses that violate the rights of local communities including their right to free, prior and informed consent. This sets a precedent for the other banks to follow.

In ‘Banking on Shaky Ground’ we showed that companies owned or linked to the international WTK Group were likely connected to land grabs in PNG. The evidence we compiled from documents on the public record showed a link between Westpac and WTK. (‘Banking on Shaky Ground’ noted that these links included records filed with the PNG government’s Information Promotion Authority.)

Now, eight months since the banks first received information about Oxfam’s research, and six months since its public release, forms were filed with the PNG Investment Promotion Authority that show Westpac no longer finances two companies in PNG linked to WTK.

What do these new forms mean?

In PNG, when a company takes out “floating charges” ― what a layperson might think of as a line-of-credit or loan relationship ― these charges are registered with the PNG government Investment Promotion Authority (IPA). To avoid jargon, we will refer to these “floating charges” as a “line-of-credit” through the remainder of this blog. Once a line-of-credit is registered, a company will then list these in its annual returns to the IPA.

They will also appear in the IPA’s company extracts. When a company no longer has credit with a bank, a new form – a ‘Notice of Partial or Total Satisfaction of Charge’ (Form 31) – is filed.

When we published the report, no Form 31 for two companies linked to the WTK Group (WTK Realty Ltd or Vanimo Forest Products Ltd) had been filed. Instead, their company extracts still listed lines of credit with Westpac, and both referred to this credit frequently in their annual returns.

We first provided Westpac with information about their possible connection with companies accused of land grabbing on 5 March 2014. We engaged with Westpac several more times and invited the bank to respond before our report was finalised. Westpac did not confirm or deny its relationship with WTK before our report was published on 28 April 2014.

On 18 November 2014, Form 31 documents for WTK Realty Ltd and Vanimo Forest Products Ltd were filed with the IPA. The IPA website also includes Westpac statements, dated 19 November 2014. In short, these indicate that the companies no longer have a line-of-credit with Westpac and that this ended in October 2000.

Normally, these documents are filed soon after the line-of-credit ends. We do not know why these documents were not filed earlier or why the line-of-credit was still referred to in IPA records years later.

A final point is worth noting. In the ‘Banking on Shaky Ground’ report we stressed the challenges of researching the secretive world of finance in relation to land grabs. This is why we are also calling for increased transparency and disclosure by the finance sector.

This case clearly outlines the challenges we face and the efforts we go to ensure our information is accurate. The fact that since our report was issued both the NAB and Westpac have developed policies to better respond to the issue of land grabs demonstrates that this is an important issue that needs addressing and we welcome the fact that both these banks have taken important steps to do this.