Tax Benefits of Donating to Charity

Your donation can help provide relief where — and when — it’s needed most. But what are the tax benefits of donating?

When you donate $2 or more to a registered charity with Deductible Gift Recipient (DGR) status, you can claim that donation as a tax deduction. That means you may be able to reduce your taxable income — and pay less tax — as a result.

To qualify, the donation must be a genuine gift. This means you can’t receive anything like a raffle ticket or merchandise in return. You’ll also need a receipt to claim at tax time.

This applies to individuals and businesses alike. Use this tax-deductible calculator to estimate your potential tax savings.

See also our resource on donations and GST.

What makes a donation tax-deductible?

Not every donation is tax-deductible. Your donation needs to meet a few conditions before you can claim it at tax time. According to the Australian Charities and Not-for-profits Commission, there are four things to check.

1. It’s a genuine gift

That means you’re giving voluntarily and not receiving anything in return — no auction items, gala dinners or prize entries.

2. The donation is $2 or more

Small donations can still add up to make a big difference, but $2 is the minimum you can claim.

3. The organisation is a Deductible Gift Recipient (DGR)

This is a special status recognised by the Australian Government. You can check an organisation’s DGR status using the ABN Lookup. Oxfam Australia is a DGR.

4. You keep a record or receipt

Most charities will send you a tax receipt by email. If you’re donating regularly, you may get a summary at the end of the financial year.

While you don’t have to claim your donation straight away, you can only claim it once — and only in the financial year you made it. However, in specific situations you can spread your tax deduction over more than one year (and up to five years).

What isn’t tax-deductible?

Some donations feel generous but don’t lead to tax benefits from donating. Here are a few common examples that won’t count at tax time.

Raffle tickets, event entries and auction bids

If you’re getting something in return (like a ticket, a gift, or the chance to win a prize), your donation doesn’t qualify as a genuine gift.

Crowdfunding contributions

Donations to individuals through platforms like GoFundMe aren’t tax-deductible unless a registered DGR runs the fundraiser.

Donated goods and services

Gifts of clothing, furniture, or time can make a big impact — but they can’t be claimed as tax deductions under ATO rules.

Overseas charities

Unless they’re registered as a DGR in Australia, donations to international organisations aren’t eligible. If you’re ever unsure, it’s worth checking with the charity or searching for them in the ABN Lookup.

EOFY tax tips for smarter giving

The end of financial year (EOFY) is the perfect time to check your receipts, review your giving and see what you can claim. Make sure you enjoy the tax benefits of donating with these four simple tips.

- Donate before 30 June. To claim your donation in this year’s tax return, you’ll need to give before the end of the financial year. Even small last-minute donations can add up.

- Set up monthly donations. Regular giving is easy to forget about when completing your tax return, but it adds up and is worth counting at tax time. Most charities will send you a tax summary around EOFY to simplify claims.

- Keep all your receipts. Save your email confirmations or download your annual statement. If you’re ever audited by the ATO, you’ll need to show proof of donation.

- Use a calculator to estimate your savings. Curious what your donation could mean for your tax return? Try this tax-deductible donation calculator to get a quick estimate.

EOFY giving doesn’t have to be rushed. A little planning now can make tax time easier and more rewarding.

How to claim your donation at tax time

Donations and tax deductions can feel confusing. But claiming your donation is simple once you know what to do. Just follow these four simple steps.

1. Check the organisation’s DGR status

Before donating, make sure the charity is a Deductible Gift Recipient (DGR). You can use the ABN Lookup to check.

Good to know: Oxfam Australia is a registered DGR, so your donations of $2 or more are tax-deductible.

2. Make the donation

Give $2 or more to the organisation. If you’re donating online, check that the donation page mentions tax deductibility.

3. Keep your receipt

You’ll need to keep a record of your donation — an email receipt or bank statement is usually enough. For regular donations, many charities will send you a summary at the end of the financial year.

4. Claim it in your tax return

When lodging your tax return, include your donation amount in the deductions section. If you’re using myTax through the ATO, look for the “Gifts or donations” section under Deductions.

If you use an accountant or tax agent, simply share your donation receipts with them (they’ll know what to do).

Why give to Oxfam Australia?

If you’re considering donating, we’d love you to consider Oxfam.

We’re a registered charity with DGR status, so donations of $2 or more are tax-deductible. But more importantly, your gift helps tackle the inequalities that fuel poverty.

From supporting women-led farming programs in rural communities to providing emergency aid in the wake of floods and conflict, your donation goes where it’s needed most. It helps people build safer lives, fairer futures and stronger communities.

We also hold ourselves to the highest standards of accountability and transparency. Our latest annual report shows exactly how we use your donations.

Together, we can build a more just and equal world, one donation at a time. And if you give before 30 June, your donation could still count toward this year’s tax return. Donate now or explore our current appeals.

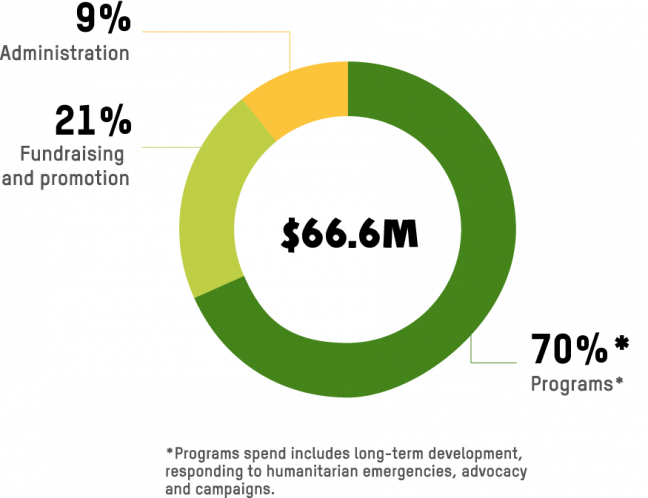

Where does the money go?

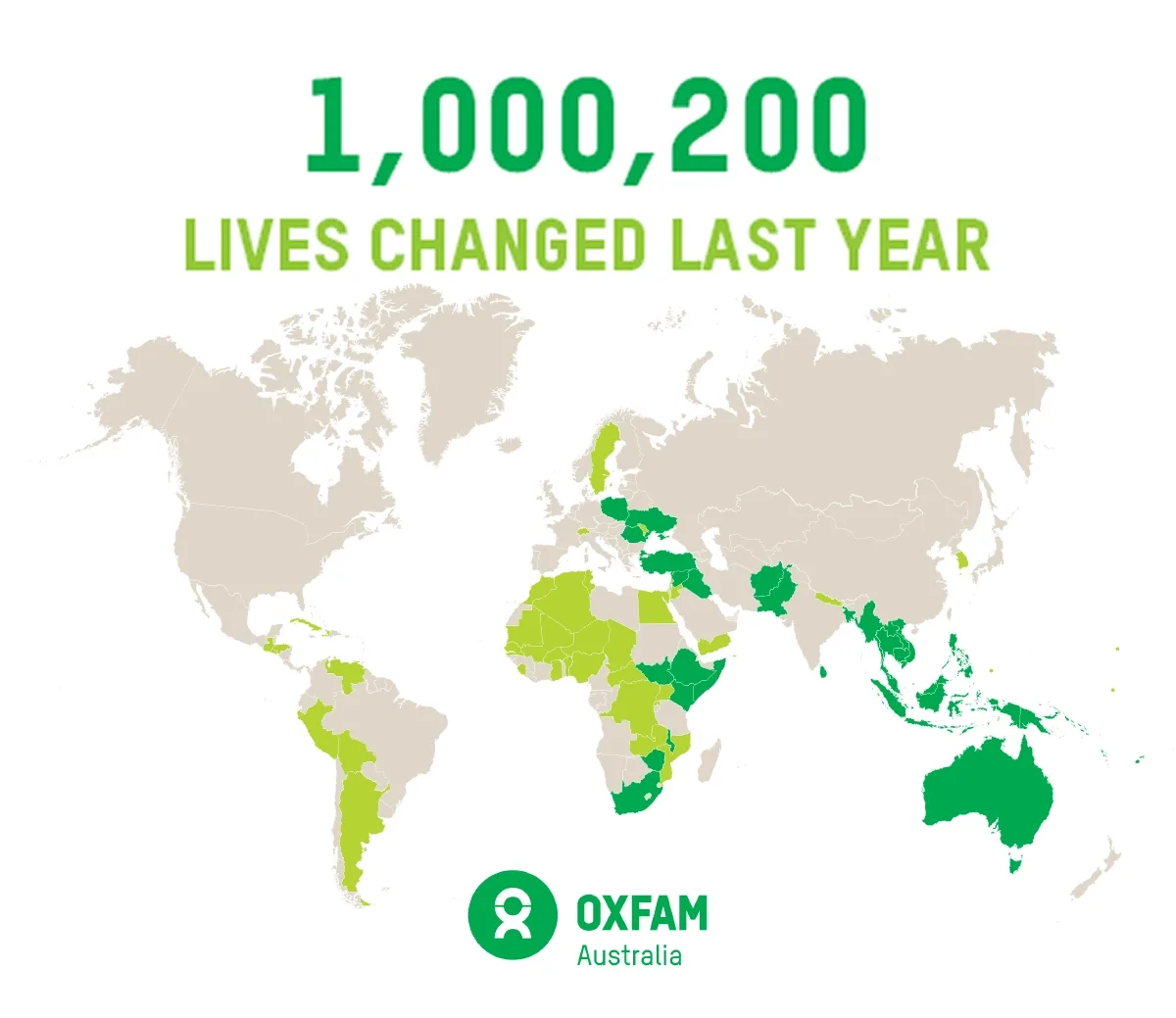

Thanks to you, Oxfam reached 15.5 million people across 90 countries around the world during 2022-2023.

Of this figure, Oxfam Australia supported more than 2.7 million people in 32 countries, including more than 1.35 million women.

Oxfam worked with 280 partners and directly impacted the lives of more than 285,000 people. We are reaching more than 2.5 million people with life-saving aid during an emergency.

Oxfam Australia also influenced more than 15,000 people and 3,400 organisations to advocate for a fairer world.

By making a charitable donation, you are helping to build more climate-resilient communities, amplify the voices of First Nations people, create opportunities for women to succeed, grow sustainable livelihoods and deliver humanitarian aid.

For every $1 we spend*:

- 63 cents is used to directly support our development and humanitarian programs around the world

- 27 cents is invested to generate future income

- 10 cents is spent on essential administration

*Based on Oxfam Australia’s consolidated financial statements for the financial year ended 31 March 2023.

FAQ: Tax benefits of donating

Are donations 100% tax deductible in Australia?

They can be if they meet all the ATO’s requirements. There’s no fixed percentage cap on donations, but the deduction only applies to the value of genuine gifts to DGR-registered charities. Just keep in mind: tax deductions reduce your taxable income, not the tax you owe directly.

Can I still claim my donation if I lost the receipt?

Yes, you can usually still enjoy a tax break for donations even if you’ve lost the receipt. If you have another form of evidence, like a bank statement or PayPal confirmation, the ATO may still accept it. But it’s best to keep official receipts where you can.

How much can I claim without receipts?

The ATO stipulates that you can claim a tax deduction of up to $10 for small cash donations (each of $2 or more) made to bucket collections conducted by a Deductible Gift Recipient (DGR) for natural disaster relief without needing a receipt. For any other donations or for amounts exceeding $10, you must have a receipt or other acceptable evidence to support your claim.

Do donations increase tax loss?

Donations reduce your taxable income. If you’ve had a low-earning year and already have more deductions than income, adding donations could increase your overall tax loss. This won’t result in a refund, but it could reduce tax payable in future years if you carry the loss forward.

How does workplace giving work?

If your employer offers workplace giving, your donations are deducted from your pre-tax income, so the tax benefit is immediate. You won’t need to claim anything extra at tax time.

Can I claim donations made in someone else’s name?

No. You can only claim donations you made yourself from your own income. If the donation was made using a joint account, the person who claims it must have contributed the money.

Want to learn more?

Read the latest news and stories from Oxfam’s charity work around the globe.

South Africa puts a stern test to G20 leaders this year to confront the scourge of global inequalitly

G20 billionaires’ fortunes rise by $2.2 trillion in just one year, more than enough to lift everyone above the global poverty line The amount of wealth that the G20’s own billionaires made just last year – $2.2 trillion – would have been more than enough to lift 3.8 billion people out of poverty, says Oxfam. […]

Australia must show real climate leadership as COP31 President: Oxfam Australia

Responding to today’s announcement that COP31 will be hosted in Türkiye, with Australia presiding over negotiations, Oxfam Australia is calling on the Australian Government to show strong climate ambition and leadership, while ensuring Pacific and First Peoples voices are at the forefront. As COP31 President, Minister Chris Bowen must commit to meaningful Pacific and First […]

Oxfam Pilipinas Responds as Super Typhoon Uwan Devastates Communities

Responding to the impact of two deadly typhoons, Super Typhoon Fung-wong (local name: Uwan) and Typhoon Kalmaegi (local name: Tino), Maria Rosario Felizco, Oxfam Pilipinas Executive Director said: “Two deadly typhoons in a span of one week in the world’s most disaster-prone country must be enough to convince the government leaders of the Philippines and […]